Over my years of holding the position of Chief Financial Officer, or “CFO,” I’ve developed and refined a formula for a successful senior finance executive. What I have determined, through my own experience and through the observation of others is that the vocation is much more an art than a science.

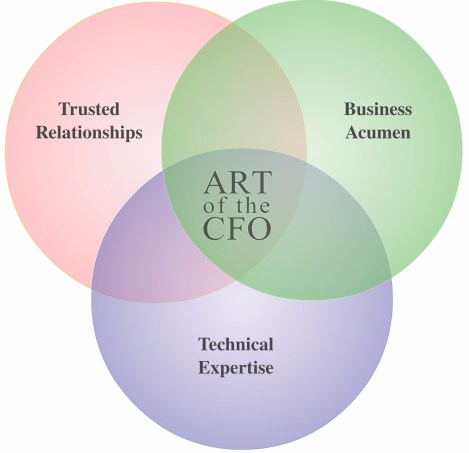

The Art of the CFO is a mixture of trusted relationships, business acumen, and technical expertise.

Where those three elements intersect, you’ll find the master artist.

The Art has these colors in its palette. The colors, when mixed well, paint a canvas that depicts an individual that is at once the proverbial “right hand” to the chief executive, a trusted adviser to the organization, an internal technical consultant, an effective coach, and a communicator of financial results and strategic direction. In addition, such an executive can be instrumental in setting strategy, and then communicating that strategy both internally and externally.

All this leads to the end goal in mind of maximizing the value of the business.

1. Trusted Relationships

Earned over time with consistency of service to others.

Trusted relationships are critical, as almost everything an effective financial executive does depends on working with or through others.

Trusted relationships are earned both in the office and out, and are important when thinking about everyone with whom the CFO has meaningful interactions, especially the CEO, peers, subordinates, board members, and investors.

The “Trust” descriptor grows from discretion, competence, candor, honesty, confidentiality, and a genuine willingness to help.

The “Relationship” part results from getting to know those with whom the executive works.

Great ways to cultivate these relationships include finding out what motivates specific people. A great way to do this is to find out what they need from you, as an executive, as well as your department, to help them to be successful individually. Helping them achieve annual bonus goals and objectives is one great way to earn trust and forge relationships. In short, serve others consistently and genuinely.

2. Business Acumen

Understanding what’s important to the operations and why.

This is gained through thoroughly understanding the company’s revenue and cost models, and being able to recognize threats and opportunities.

Most effectively, business acumen is earned by getting involved in operations at the transactional level. A successful financial executive should consider shadowing the front-line employees who interact with customers and even going on customer calls with salespeople. With this experience, the effective financial leader expands understanding, empathy, and appreciation for the challenges and opportunities facing the business.

3. Technical Expertise

Honed ability to ask the right questions of the right people at the right time.

Technical expertise is the “price of poker.” Without some level of understanding of the technical requirements of the job, an individual has no business holding the top finance spot. The technical areas of import in this case are most often accounting, tax, and legal. Of course, the executive need not be the preeminent expert in each of those areas, but they do need to be at least proficient and informed enough to be able to ask the right questions at the right time.

Each of these play a critical role in the CFO’s ability to maximize shareholder value.