There are hundreds of articles circulating the internet explaining how the latest software can reduce the time to close and report monthly financial results, while also improving accuracy. The fact of the matter, though, is that based on my years of experience, most businesses already own more than enough technology to achieve this same outcome. What they may benefit from, though, is a disciplined and optimized closing process.

One of the most common complaints about accounting departments is that they take too long to report financial results, a process often referred to as the “monthly closing.” The reason this monthly chore takes so long is that there are many thousands of transactions to review and categorize after the end of each period. Further, there can be dozens or hundreds of contracts to evaluate for appropriate treatment. All of that review takes a lot of accountant-hours to accomplish, leading to delays in financial reporting that can be measured in several days to even weeks.

To reduce the amount of time to close the books, a technique that I have used with success is a “real-time” closing.

Understand the Value of Reducing the Time to Close

Of course, the obvious reason for tackling this endeavor in the first place is that there is commercial value in doing so. That is, the faster the business’s management has usable and actionable data, the more value it can create by adjusting operations.

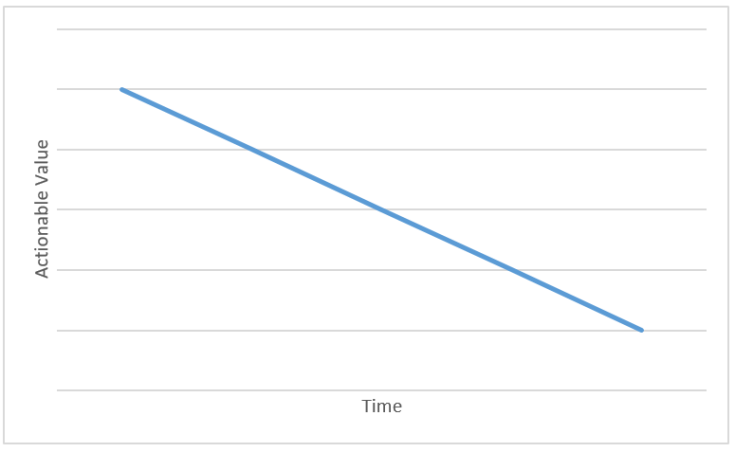

Consider of the following chart:

As time advances along the horizontal axis, the actionable value of financial data declines. Therefore, the faster the accounting department can generate its month-end reporting package, the more valuable it can be.

As an additional value-creator, consider redeploying (or downsizing) your accounting department. For instance, if a full week can be removed from the close process each month, that represents a 25% efficiency gain. Those resources that were previously employed to execute a close process are suddenly available for other margin improvement projects, or even cost reductions.

Action Steps:

Close the Books Every Day

So, here’s the big secret: Close your books every day! Then, when the end of the month comes, you’ll already know the complete financial results, because you’ve been working on it all month long.

Perhaps the daily regiment is a bit burdensome, but staying abreast of transactions as they happen is vitally important. By reviewing transactions on a regular, daily, basis throughout the month, the accounting department won’t be surprised at the end of the month with a mountain of work, since the vast majority has been done already, in real time.

Estimate Accruals Before Month-End

There are some tasks that just can’t be done until the end of the month. Most organizations are burdened with the requirement to utilize accrual accounting (rather than cash accounting), so month-end adjustments are always required to previously recorded estimates as a matter of course. However, in my experience, almost all of these can be completed prior to the end of the month. At a minimum, estimates of these so-called “accruals” can be recorded near the end of the month, and then trued up very early the following month. This reduces substantially the effort required in that month-end close “crunch” time.

Close the Books with Estimates

Especially during non-quarter-end months, closing the monthly financial records with estimates can be more valuable than waiting longer for precision. This adds a third dimension to the above graphic, whereby precision costs time, and time costs actionable value.

As an example, one of the typical “long poles” in the close process is waiting for final invoices to arrive from vendors. If it can be broadly generalized that the total amount of invoices received after the third day of the closing, for example, is a certain amount, then that dollar figure can be recorded as an accrual, to be trued up the following month.

Of course, during the end of each quarter, more precision may be required, but for the other 8 months of the year, this technique can provide real value.

In short, if there’s an opportunity to use an estimate to get the books closed faster, the cost of any imprecision can be more than outweighed by the value of actionable information.

Review a “Flash Close” in Detail

One tactic to improve time to close that often works well is an early “flash close.” This is a planned, early look at the monthly financial results, prior to the completion of final reviews and accruals. With the understanding that it lacks precision and rigor in some areas, it can still be valuable in informing management as to what to expect when the final financial results are published.

Keep the Trial Balance Reconciled

This notion is fairly “inside baseball,” but is vital to the efficient operations of a high-performing accounting department. A business’s income statement is routinely scrutinized by its operating managers, as they are usually compensated based on earnings performance. However, the driving financial statement is the balance sheet, which can often be neglected and hide all manner of poor accounting hygiene.

By ensuring that all balance sheet accounts are properly reconciled every month, the confidence in the income statement is increased, allowing for a greater reliance on the earnings numbers without as rigorous of a post-transactional review.

As to the timing of when these reconciliations are completed, there are some balance sheet accounts that need to be reconciled before the month closes. This list of accounts varies depending on the type of business and other factors, but the vast majority of accounts are comparatively unchanging and can be reconciled after the books are closed. So, there’s no need to hold the month open until all accounts are reconciled, because if the balance sheet is tightly reconciled and controlled on a monthly basis, confidence in the income statement accuracy improves.

Relentlessly Attack the “Long Pole”

When all these steps have been addressed, then identify the last task in the monthly close process. Ask why that is the last task, can it be done sooner, and is the current precision required and/or valuable?

Once that task has been reviewed, proceed to the next-to-last item in the process, asking the same questions, and so on. At the end of that review, the entirety of the close process will have withstood a detailed evaluation, and will result in a tighter financial close process that maximizes value to the business.

Barriers to Success

In my experience, the single biggest barrier is the same as with any other business process improvement, which is asking people to change the way they think, also known as a change in culture.

This can manifest itself in several different ways and areas, including:

- management’s comfort in knowing that the accounting results are undeniably precise, at the cost of timeliness,

- an accounting department not willing to release anything other than “perfect” numbers, and

- resistance from other departments, whose input is required to report results, including sales, procurement, or legal.

To overcome these barriers, this process change needs to be led by the accounting department, but also be supported and advocated by senior management.

Leave a comment